Freddie Mac’s Family Possible financial was financing program available for homebuyers that have reduced income otherwise absolutely nothing in the offers. It requires only a good 3% down-payment.

Who is qualified to receive a property You are able to loan?

Since the Household You are able to financing is actually for low-money homeowners only, your loved ones money should fall under 80% of one’s area’s average to be considered. You can utilize Freddie Mac’s qualifications unit to see if your earnings match that it tolerance near you. (Inside the infrequent cases, portion might have no money restriction.)

Outside of the money limits, there are lots of most other standards you will need to meet to utilize property You can easily home loan. These include:

- You really need to have a credit history with a minimum of 660 and you will financing for around a step 3% down payment. These could feel funds from savings, a gift off family members, otherwise that loan or offer acquired as a result of a down payment assistance program

- At least one borrower (you either otherwise your own co-borrower) need take your house you happen to be to shop for https://paydayloanalabama.com/concord/ since your number one quarters. Land around five-unit properties meet the requirements.

- Their monthly financial obligation-to-earnings proportion must not exceed 43%. Their projected casing expenditures – as well as your month-to-month mortgage payment, fees, insurance coverage, and you will interest – generally cannot exceed 35%.

If you are a first-big date homebuyer or if you has actually a restricted credit history, you must over a great homebuyer education path.

Freddie Mac computer House You can easily earnings restrictions

The cash constraints is tight into the House It is possible to loans, since these mortgage loans is designed specifically for down-money People in america. To-be eligible, the annual household earnings cannot be more than 80% of one’s median income to suit your area.

New median money during the Lansing, Michigan, such as, try $79,one hundred. Since 80% of this was $63,280, you would have to build lower than so it add up to getting eligible for a house You can Loan.

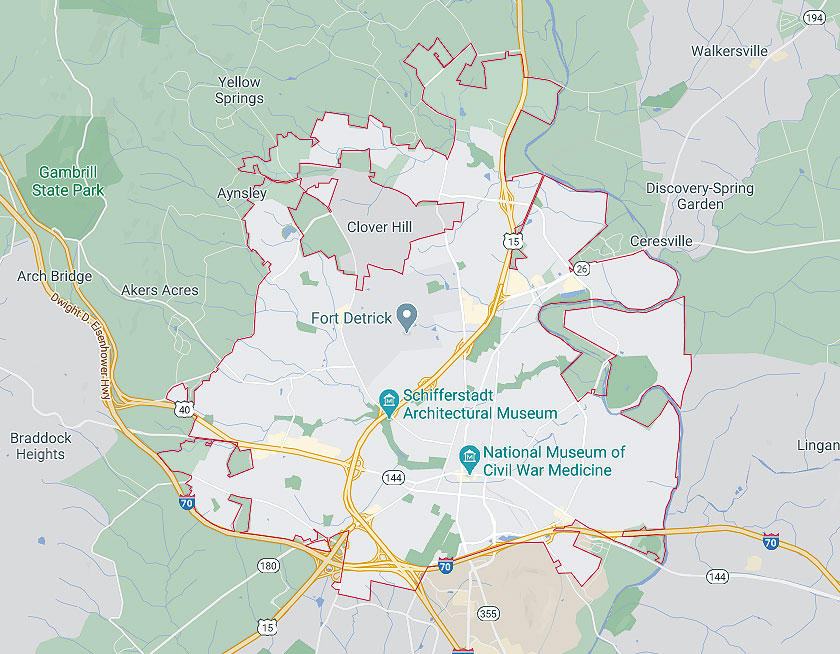

Freddie Mac’s map product can help you dictate the room average money. It can also help link one to worthwhile advance payment recommendations info if needed.

The house You’ll be able to financing isn’t the simply home loan selection for lowest-earnings homeowners – otherwise men and women small towards savings. In fact, there are lots of most other home loan programs offering low-down repayments. Occasionally, you are capable avoid a down payment entirely.

- FHA funds: Talking about loans protected of the Federal Homes Administration. FHA funds want from step three.5% to ten% off (according to their borrowing from the bank). Nonetheless they support low credit scores, particularly compared to other mortgage apps. Minimal credit score falls so you’re able to five hundred having get a hold of loan providers.

- Old-fashioned 97 funds: Old-fashioned finance want the absolute minimum 3% down payment. Financial insurance policy is along with cancelable within these funds, that can allow you to lower your payment per month later off the latest line.

- Fannie mae House In a position financing:Household In a position money try Fannie Mae’s variety of Home You’ll Mortgage loans. They require merely a beneficial 3% downpayment and you can include reduced mortgage insurance fees. Nonetheless they allow for credit scores as little as 620.

- Va mortgage brokers: Speaking of finance protected from the Company from Veterans Things and you may appear simply to army people, pros, and their spouses. Needed zero deposit, feature low interest, and you can limit the closing costs individuals will likely be recharged from the its loan providers.

- USDA financing: USDA money was backed by the brand new Company off Farming, and they’re for use in more outlying and you can, in some cases, residential district areas. Eg Virtual assistant financing, they want zero down payment. These loans have certain assets qualifications requirements. To see if property you’re interested in is eligible having an excellent USDA financing, take a look at eligibility chart.