HECMs is the just contrary mortgages covered of the Government. Next, described as a proprietary reverse financial, try a mortgage that’s made in conformity towards the conditions of brand new York’s Property Rules Section 280, or 280-a great. Region 79 pertains to one another proprietary and you can HECM reverse mortgages.

1st difference in a HECM and you may proprietary contrary financial questions the maximum loan amount offered significantly less than each type of financing. Within the HECM system, maximum amount borrowed was capped. Proprietary opposite mortgages, on the other hand, lack a cover. Its for this reason that they’re have a tendency to known as the jumbo contrary mortgages.

Generally, the loan number is large in case the homeowner are more mature, the worth of our house high and/or interest levels is actually all the way down

- Very own your property

- Become no less than sixty years old (as stated significantly more than, certain kinds of reverse mortgages provides a top decades criteria)

- Reside in your residence for over half of the season

- Provides just one-family home, a-1- so you’re able to 4-tool strengthening otherwise an effective federally-accepted condominium or prepared tool advancement

- Do not have liens in your family or be eligible for an enormous adequate payday loan from the contrary mortgage to pay off people current liens

- In case your home means actual repairs to qualify for a face-to-face financial, qualify for an enormous sufficient pay day loan on the opposite financial to fund the expense of solutions

The level of the loan is determined by the sort of contrary mortgage, age the newest borrower, the worth of the house and you may most recent interest levels.

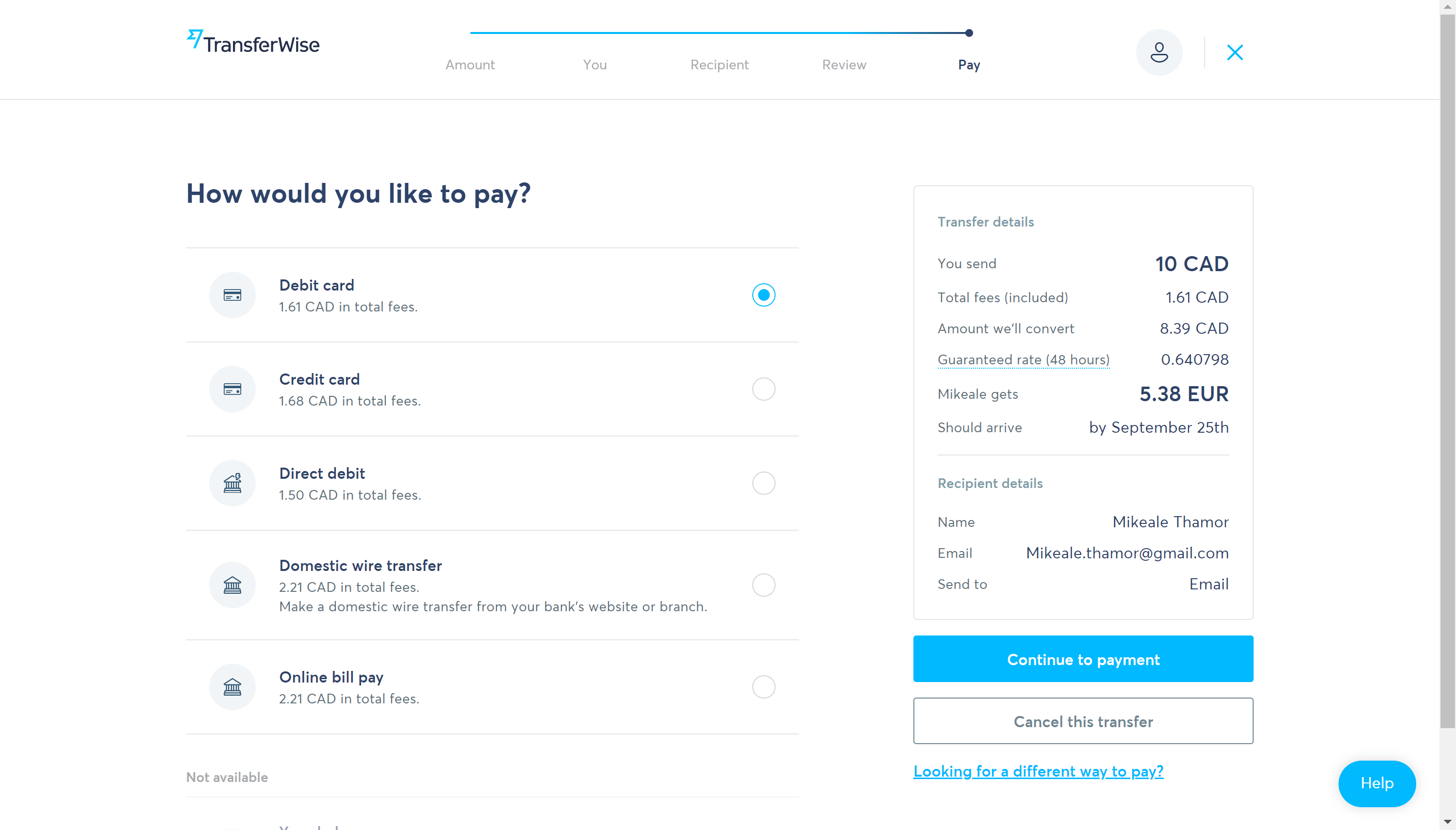

Contrary home loan continues will be delivered in many ways, such instant cash advance, personal line of credit, otherwise month-to-month payday loans. Not every choice could well be offered to all the borrower, so it’s crucial that you make sure you learn the choices by conversing with their bank and you will an attorney otherwise houses specialist.

Prior to americash loans Grand Bay closure towards an exclusive contrary financial not as much as The York’s Genuine Assets Laws Point 280 or 280-a good, really the only charges a lender can get gather of a debtor in advance of closure are an application fee, an appraisal fee, and you can a credit file percentage. You to application commission should be designated as such and you can ount regarding the reverse home loan or of number funded. Having a great HECM mortgage, indeed there is literally zero independent application commission because you to payment are use in the fresh origination fee gathered within closure.

The initial, known as a HECM opposite mortgage (otherwise 280-b), try a mortgage loan that’s built in accordance towards criteria of the home Equity Transformation Mortgage program operated by Government Houses Government

In exchange for a lowered interest the financial institution plus the borrower could possibly get agree to collateral contribution. Participation mortgage loans are incredibly titled once the bank gets involved, otherwise gets the directly to a portion in virtually any upsurge in the value of your residence.

A provided Appreciate Mortgage (SAM) takes into account the fresh new enjoy inside the property value the house anywhere between the amount of time the borrowed funds are signed and also the prevent of your financing identity. The lending company receives a consented-so you can portion of this new liked property value the borrowed funds if loan try ended.

Part 79 applies one another to the people groups necessary to become subscribed because of the Agencies because a mortgage banker and the ones communities excused regarding licensing because the a home loan banker significantly less than Post several-D of the latest York’s Banking Law.

Yes, in the event one reverse mortgage lender will require your arises from a contrary financial commonly earliest visit repay the balance of one’s existing mortgage. As such, an existing mortgage will reduce level of the web based loan continues you are going to receive not as much as a contrary home loan. When it comes to if an opposite home loan is right for you, you will need to seek advice from a construction specialist if the web loan proceeds will be enough so that you can alive in your house. A summary of New york low-funds property counseling businesses is present.