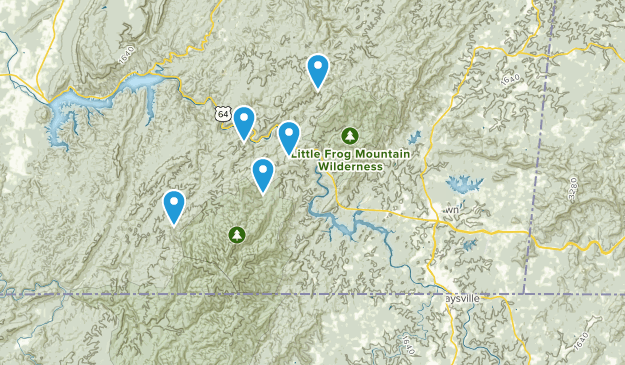

step 1. USDA mortgage

Homeowners looking to a devote an outlying urban area may want to make use of this mortgage. Rates of interest are competitive, while need-not set anything down. The house or property must be within the a being qualified region of that pull out good USDA mortgage.

2. FHA loan

FHA finance are easily open to property owners that have lowest credit scores. If you make a good ten% deposit, you can buy an enthusiastic FHA mortgage even although you enjoys good five hundred credit score. When you yourself have a beneficial 580 credit history or higher, you can purchase a keen FHA mortgage. The brand new FHA are a compliant loan that have limitations precisely how far you could potentially acquire regarding the financial. People limitations alter every year and depend on the brand new area’s prices out of way of living.

step 3. Antique loan

Old-fashioned loans are not insured otherwise protected by the regulators. While they tend to have more strict credit score criteria, some loan providers provide antique loans so you can borrowers having a credit rating from 650. Yet not, it could be more challenging so you can safe favorable words and you will desire prices as compared to individuals which have higher credit scores.

cuatro. Va mortgage

Virtual assistant loans is exclusively for veterans exactly who supported before or was earnestly serving. Continuer la lecture de « How exactly to alter your home loan prices with an effective 650 credit history »